The establishment of a company in a country is conditioned by a good knowledge of the costs related to the management of the personnel, as well as to the various charges such as social security, health insurance and in particular, the taxation of companies.

For the latter, it is up to the company to calculate or liquidate its tax itself. Then declare it to the tax authorities.

This method seems simple at first sight, but in practice, vigilance is required, because calculating your own tax means mastering the tax regulations, then mastering the calculation method for each type of tax, as well as the frequency of the declaration (monthly, bi-monthly or annual). Indeed, for each delay, error, or inconsistency in the declaration, the company risks a tax penalty or a tax audit.

Types of taxes

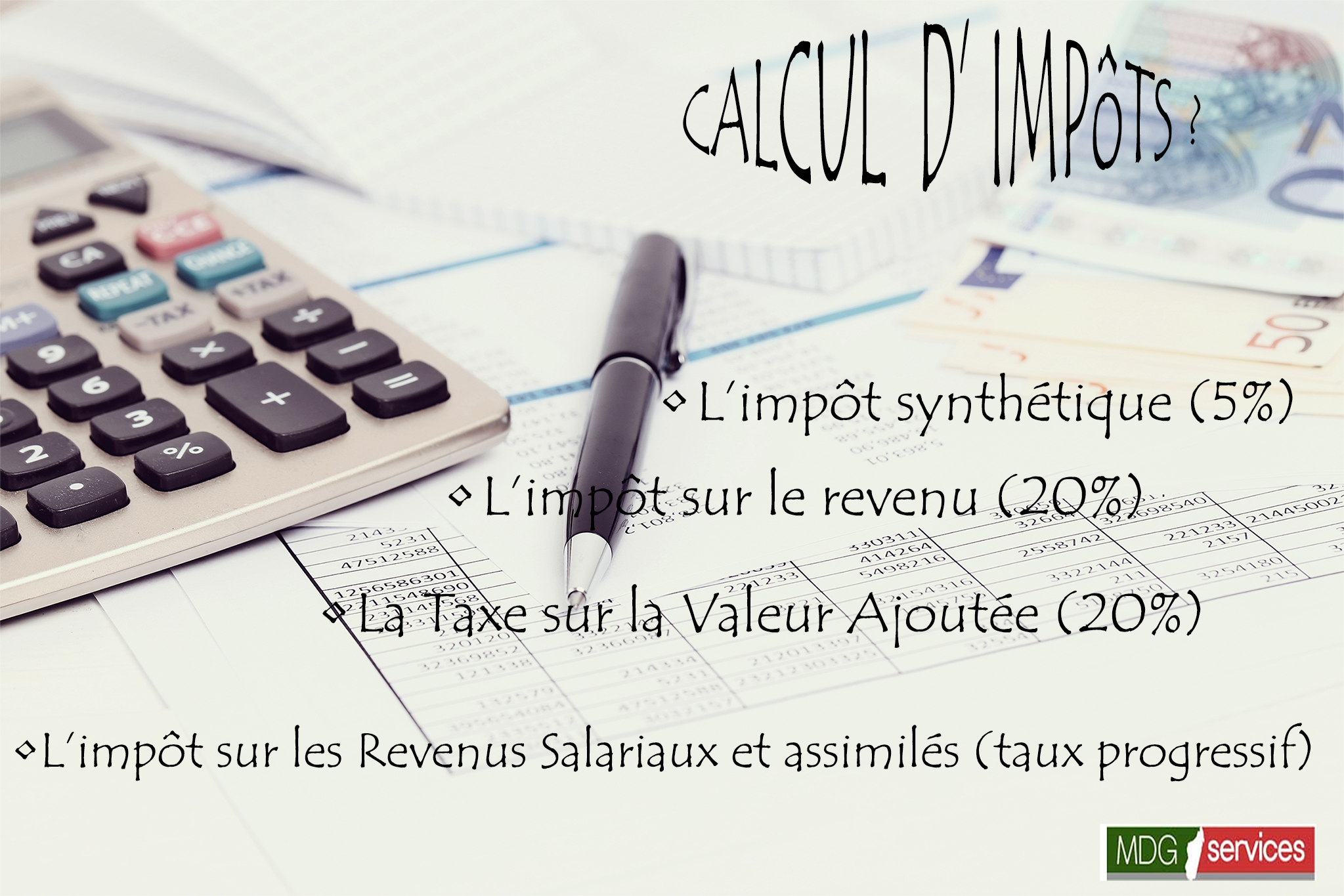

In general, a corporation is subject to four types of taxes, namely:

- The synthetic tax (IS) with a rate of 5%.

- Income tax (IR) with a rate of 20%.

- Value Added Tax (VAT) with a rate of 20%.

- Tax on Salary and Similar Income (IRSA) : with a progressive rate

Learn more about the main tax returns in Madagascar

The ideal tax system for my business

With its relatively low rate of 5%, the synthetic tax (IS) seems to be the best solution. However, the choice of the tax system is crucial, and several parameters must be observed.

Indeed, the synthetic tax is calculated on the basis of the company’s annual turnover. It is advantageous for companies with a lower turnover. On the other hand, for a company with a significant turnover, it is advisable to adopt the IR system (income tax) which is based on the company’s NET profits.

Need an accompaniment in tax matters, call MDG Services.

We accompany you :

- In the establishment of your tax returns

- In the filing of the declarations within the deadlines

- During possible tax audits