In order to promote the activities of certain social and other organizations, products are exempted from VAT (Value Added Tax). The exemptions vary according to the budgetary orientations of the Finance Law each year, as is the case in Madagascar.

Taxable Activities in Madagascar

The scope of VAT in Madagascar applies to businesses carried out in Madagascar by individuals or legal entities that:

- Purchase for resale

- Perform acts related to commercial, industrial, agricultural, artisanal, mining, hotel, gambling, service provision, or liberal professions activities

Unless an exemption applies (see below).

These taxable activities include:

- Imports

- Deliveries of goods and services

- The execution of construction works

Exemptions :

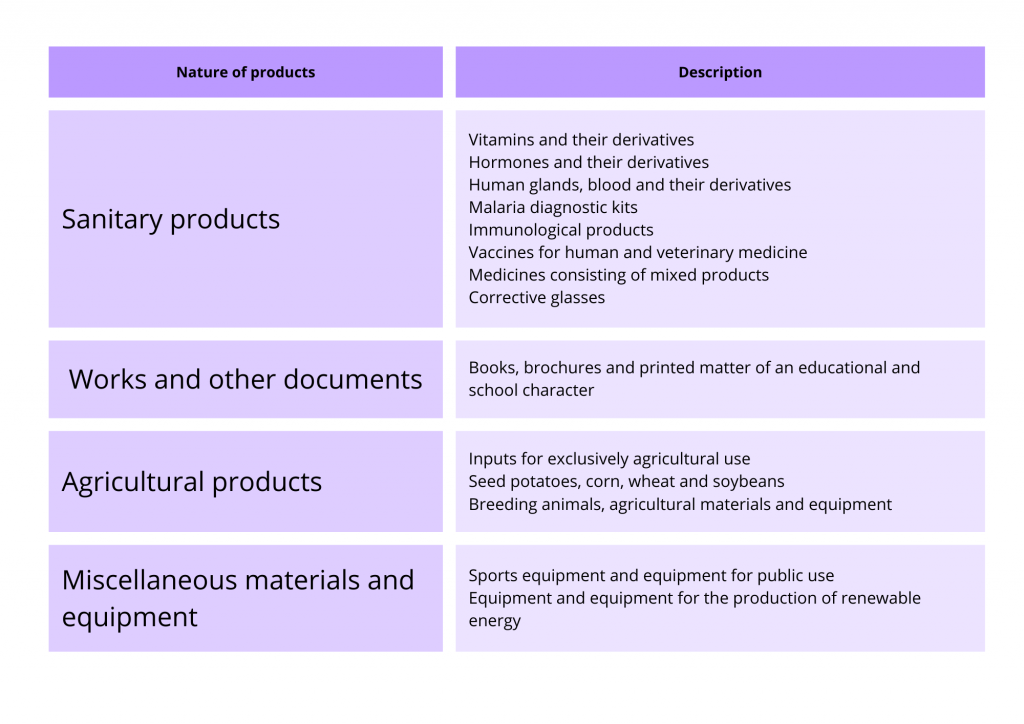

- Certain products and services are exempt from VAT, as listed in Article 06.01.06 of the General Tax Code.

- Contraceptive products and operations of supplies of goods, services, and works carried out by public procurement contractors may also be exempt, subject to the adoption of the 2020 Finance Bill in Madagascar.

In addition to outsourced human resources management, which is chosen by several companies in Madagascar, it is also possible to proceed with a tax outsourcing of a resident company.